cp58 income tax malaysia

Company must submit Form CP107D for 2 Withholding Tax for agents commissions surpasses RM100000 within 1 year effective from 1st January 2022 steps to generate CP107D. The rebates and deductions are for book purchases insurance medical expenses and others.

7 Common Income Tax Filing Mistakes To Avoid Mypf My

Semak Status Permohonan.

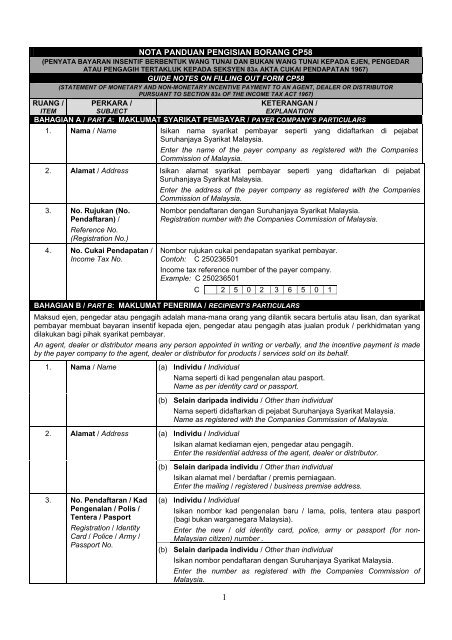

. Income Tax Number and others information in CP58. PCB CP22 CP38 CP39 CP58 BIK EA Form Form E Form TP. Calculation is based on Income Tax Act 1967.

Compliant with employment requirements in Malaysia. BIK Malaysia stand for Benefit in kind is a tax benefit provided by the employer in non cash how to calculate the value of Malaysia benefit in kind BIK. Withholding tax will be deducted based on the rate listed in the table regardless if the tax has already been deducted or not.

SQL Payroll software - Best HR with E-leave cloud compliant with Malaysia law ie KWSPEPF Income Tax LHDN PCB SOCSO EIS etc download free trial now. Chan Chun Lam Low Partners. Inclusive of KWSP SOCSO LHDN EIS HRDF EPF Borang A SOCSO.

Average Lending Rate Bank Negara Malaysia Schedule Section 140B Restriction On Deductibility of Interest Section 140C Income Tax Act 1967 International Affairs. 6Keep and retain records for 7 years and make it. Join us and start using the best accounting software in Malaysia.

The TP1 is an income tax form that is given to the employer by the employee to ensure that the MTD monthly tax deductions have taken into account the necessary rebates and deductions. SQL Payroll software Malaysia is malaysia best payroll software that compliant auto calculating KWSP SOCSO LHDN PCB HRDF with comprehensive report. PCB CP22 CP38 CP39 CP58 BIK EA Form Form E Form TP.

Klik untuk muat turun. The TP1 form is an income tax form that is given to an employer by an employee to make sure that all necessary rebates and deductions have been accounted for in the MTD monthly tax deductions. It will be declare in CP58 2022 if the total commission for 2021 amounts to more than RM100000.

Borang CP58 Individu yang menerima komisen contohnya ejen-ejen penapis air MLM Takaful Unit Trust Remisier. Garis Panduan Permohonan Untuk Kelulusan Ketua Pengarah Hasil Dalam Negeri Malaysia Di Bawah Subseksyen 446 Akta Cukai Pendapatan 1967 Bagi Tabung Pembelian Sekolah Agama. Income Tax CP22 is a form that has to be submitted by the employer to notify LHDN on the newly recruited employees where else income tax form CP22A is a form that is submitted by the employer to notify LHDN on any employees in the cease of employment in forms of retirement or leave Malaysia permanently.

Pasport dan sijil pendaftaran perniagaan bagi bukan warganegara Malaysia yang menjalankan perniagaan. 6Keep and retain records for 7 years and make it. Form CP58 on or before 31 March of the following year.

The income tax exemption limit for compensation for loss of employment will be increased from RM10000 to RM20000 for each full year of service. Form CP58 on or before 31 March of the following year. SOCSO EIS HRDF Others.

SOCSO EIS HRDF. 2Make monthly tax deduction MTD from employees remuneration based on either the Schedule of MTD or the computerized calculation method and remit the amount of MTD to the IRBM on or before the 15th day of the subsequent month. Deductions and remunerations in the form of book purchases insurance medical expenses and will be accounted for in the TP1 form.

2Make monthly tax deduction MTD from employees remuneration based on either the Schedule of MTD or the computerized calculation method and remit the amount of MTD to the IRBM on or before the 15th day of the subsequent month. Pusat Panggilan Bayaran Cukai CP58 Penerbitan Cukai EduZone Pengumuman Maklum Balas MyTax Sekatan Perjalanan Maklumat Lanjut. Inclusive of KWSP SOCSO LHDN EIS HRDF EPF Borang A SOCSO Borang 8A Income Tax CP39 and Borang E ready.

Socso Borang 2 Socso Borang 3 EIS Lampiran 1 EIS Borang 1 EIS Borang 2 Income Tax CP 39 Income Tax CP 39 A CP 22. PCB CP22 CP38 CP39 CP58 BIK EA Form Form E Form TP. Factors Influencing the Intention to Use Monthly Tax Deduction As Final Tax Among Employees in Bangi Malaysia kini boleh didapati di Portal Rasmi HASiL untuk dimuat turun.

The CP38 notification is issued to the employer as supplementary instructions to clear the balance of tax liability of employees over and above the Monthly Tax Deductions MTD 30th June 2022 is the final date for submission of Form B Year Assessment 2021 and the payment of income tax for individuals who earn business income. Practical Tips on Transfer Pricing for SMEs by Song Liew Tzen Hsiung Wang Choo Jad ANC Group of Tax Consultants. Enter your desired tax payable amount and using the reverse calculator our system will calculate the gross income in order to fulfil your expected tax bracket.

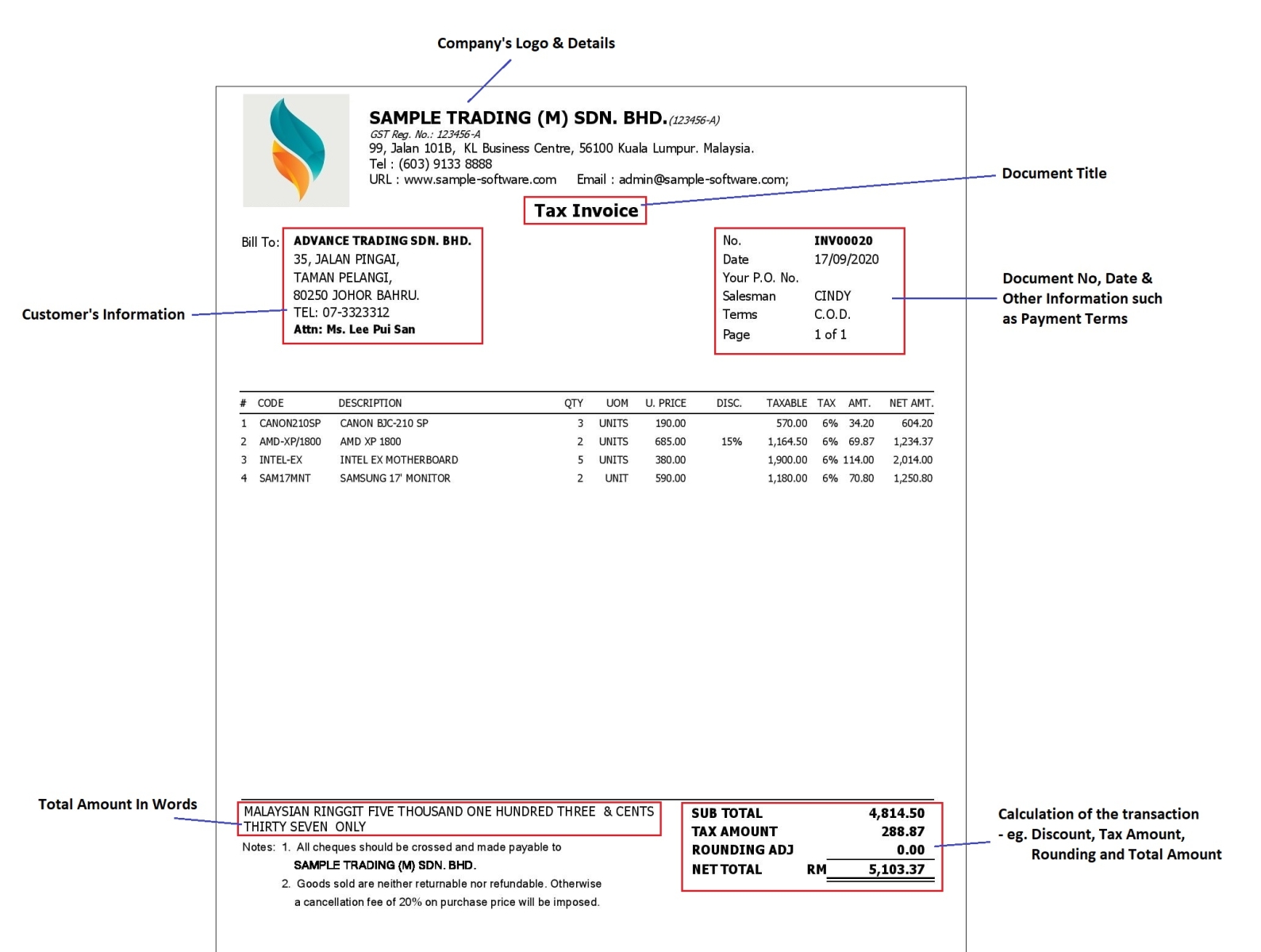

Awarded 2019 Best Accounting Software Best in Customer Service Award in 2021. Issue invoices for. Guidelines For Income Tax Treatment Of.

1 Accounting Software in Malaysia We empower more than 600000 accounting and business professionals using SQL Account and SQL Payroll to perform their daily operation effectively. Payment of the tax needs to be made to the Director General of Inland Revenue within 1 month after the payment has been made to the payee. 603-7785 2624 603-7785 2625.

Companybusinesscorporate tax 16 Form CP58 3 Form BE 3 Form E 6 Form EA 5 Form b 9 Form P 9 Form C 2. Form CP58 LHDN Form 58 CP 58 shall be provided to the agent dealer or distributor not later than 31 March in the year immediately following the year in which the incentives mentioned above are paid. The rate of deduction and rebates depends on the approval of the employer.

Rockwills Malaysia Balan Nair. Any payer which fails to prepare Form CP58 LHDN Form 58 CP 58 as required under this Section shall be guilty of an offense and shall on conviction. Caranya dengan membuat e-filing.

PCB CP22 CP38 CP39 CP58 BIK EA Form Form E Form TP. Pengedar Atau Pengagih Dalam Borang CP58 Bagi Maksud Peruntukan Dibawah Seksyen 83A Akta Cukai Pendapatan 1967 ACP 1967. Level 4 Lot 6 Jalan 5121746050 Petaling Jaya SelangorMalaysia Tel.

SOCSO Borang 8A EIS Borang 1 EIS Borang 1A EIS Borang 2 EIS Borang 2A EIS Lampiran 1 Income Tax CP39 CP39A Income Tax CP. For example If you want your tax payable amount is RM 8000 what you need to do is insert RM 8000 and SQL tax calculator will calculate the yearly income to be reported to LHDN for you. Selepas daftar income tax barulah kita boleh declare income tax.

Borang Cp 58 Company Secretarial Accounting Taxation

Nota Panduan Pengisian Borang Cp58

Updated 2021 Tax Reliefs For Ya 2020 And How To File Income Tax In Malaysia Using Lhdn E Filing Iproperty Com My

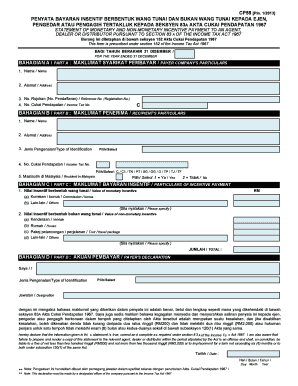

What Is Cp58 Who Needs To Fill In Cp58 Form Sql Payroll Hq

.jpg)

Mco 3 0 10 Key Tax Questions Answered S Saravana Kumar And Nurul Imani Hamzah Malay Mail

Our Cp58 Form For Tax Declaration Live Well With Shaklee Facebook

Amengo Management Amengobiz Twitter

What Is Cp58 Statement Of Monetary And Non Monetary Incentive Payment To Agent Dealer Or Distributor Sta

Ktp 𝐇𝐚𝐯𝐞 𝐲𝐨𝐮 𝐂𝐏 𝟓𝟖 Everyone Know Form Ea For Sure Facebook

Malaysia Income Tax 难逃lhdn五指山之cp58 Youtube

Cp58 Sample Fill Online Printable Fillable Blank Pdffiller

7 Common Income Tax Filing Mistakes To Avoid Mypf My

What Employers Must Know About Form E Submission 2017 Mcsb Systems Sdn Bhd

Invoice Sample Malaysia Qne Software Sdn Bhd By Deepak On Dribbble

Ktp 𝐇𝐚𝐯𝐞 𝐲𝐨𝐮 𝐂𝐏 𝟓𝟖 Everyone Know Form Ea For Sure Facebook

Form Cp58 Lhdn Form 58 Cp 58 Income Tax Malaysia

The Tax Estimate For Ya 2021 Rm240000 Shall Not Be Less Than 85 Of The Tax Course Hero

.png)

Comments

Post a Comment